The role of Crypto’s Thought Leaders is to create stories that explain why coins gained or lost value. The line moving up and down on a chart is never just a line, but a part of a larger technological or economic trend. These backfilled narratives can be compelling (“Digital Gold”, “The World Computer”) or not (“Play-to-Earn is the future of work”), but it’s important to critically examine how each frames the world — and who benefits from that framing.

The blue-collar, lunch-pail VCs at the narrative factory have been working overtime to explain ETH’s underperformance relative to BTC and SOL. Some of these arguments are non-controversial: that the Ethereum community should better align on a shared direction, reevaluate its technical assumptions, or just ship better.

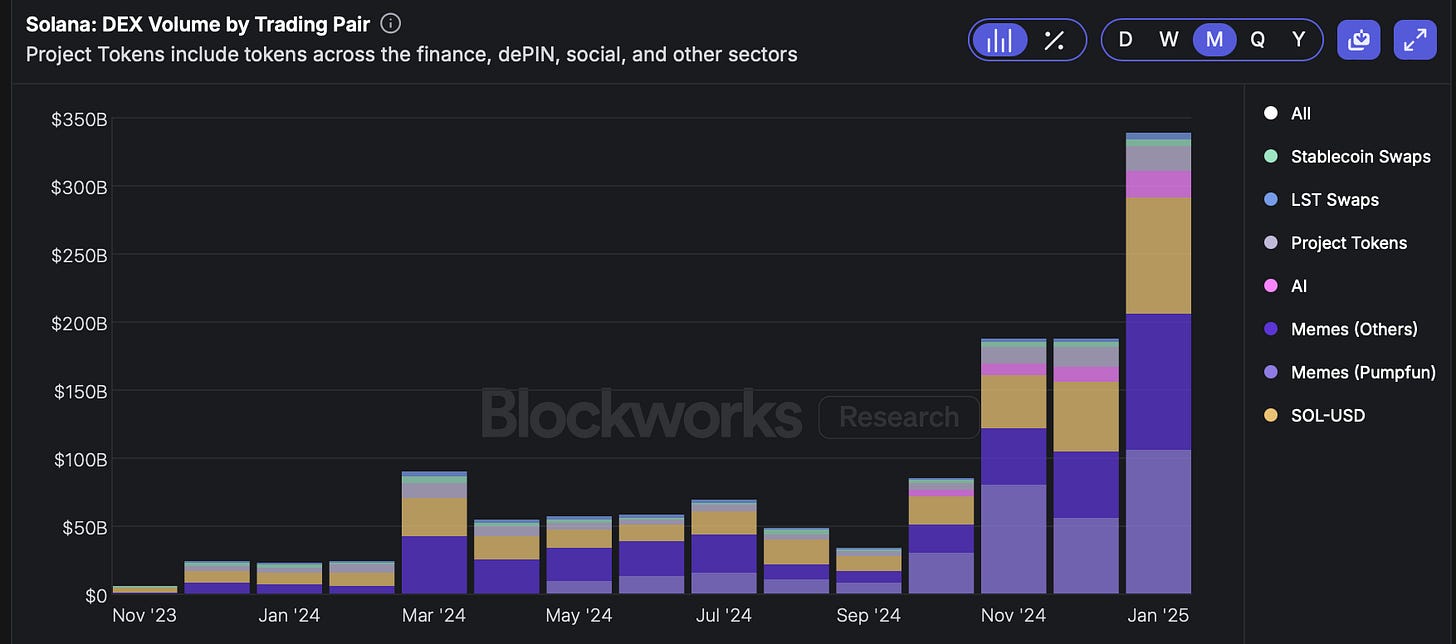

This post argues that a particular narrative about Solana and Ethereum is wrong. The story is something like this. Solana is dominating Ethereum in the most important economic metrics for a blockchain, particularly DEX volume and REV (Real Economic Value = MEV + transaction fees, a measure of protocol cash flow).

According to this story, Solana’s lead in REV is due to technical superiority and traction across many app categories. SOL can be valued based on projected future REV, an advantage over ETH, which can only be valued based on vibes or “money-ness.”

But this is just a narrative. Solana’s REV is entirely generated by memecoin trading, making it difficult to value SOL based on future cash flows. Moreover, memecoin dominance creates structural risk for Solana.

Follow the REV

Over the last year and a half, SOL/ETH has gone up by about 10x. Anytime we see price action like that, we know it’s time to backfill a narrative.

One story that we can tell is this: Solana has superior technology, users love it, and the best developers across all categories - DePIN, DeFi, Payments, and, sure, memecoins - moved to Solana.

The VC class will argue that this vast migration of talent has led to incredible growth in the most important metrics, like REV, trading volume, and application revenue. SOL doesn’t have to be money or a commodity like ETH, the story goes, because its market cap will eventually be justified by a reasonable multiple of actual revenue, not some memetic bullshit.

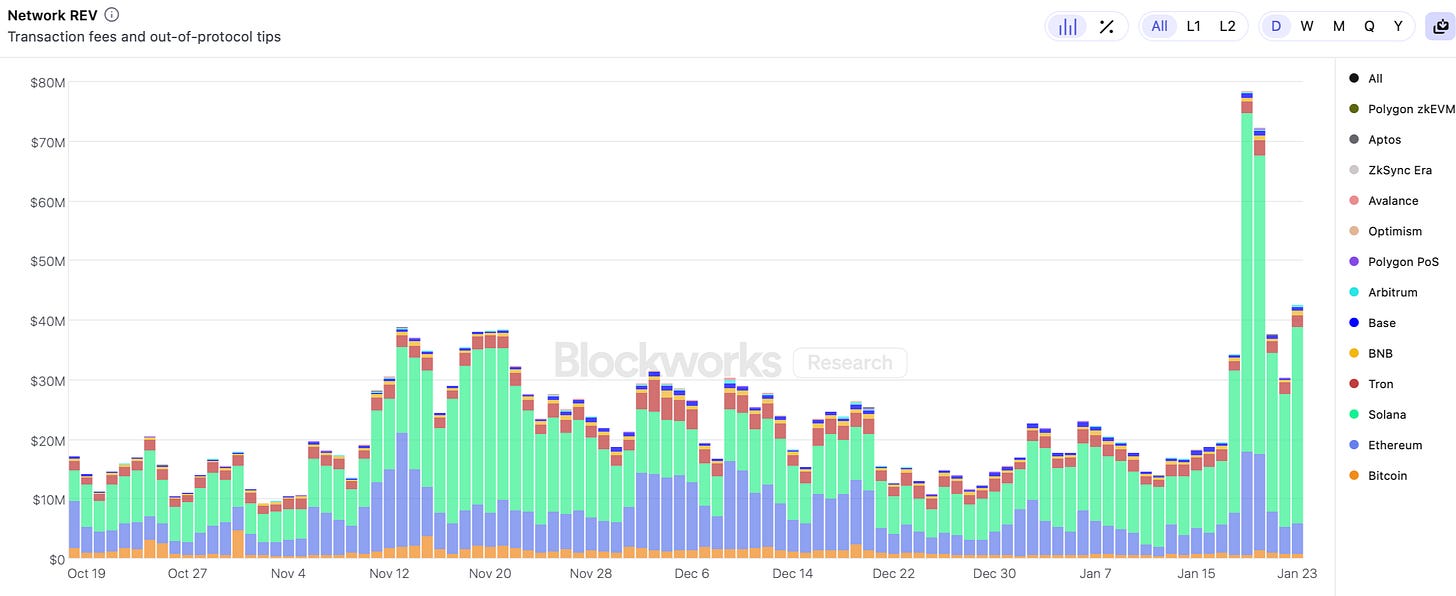

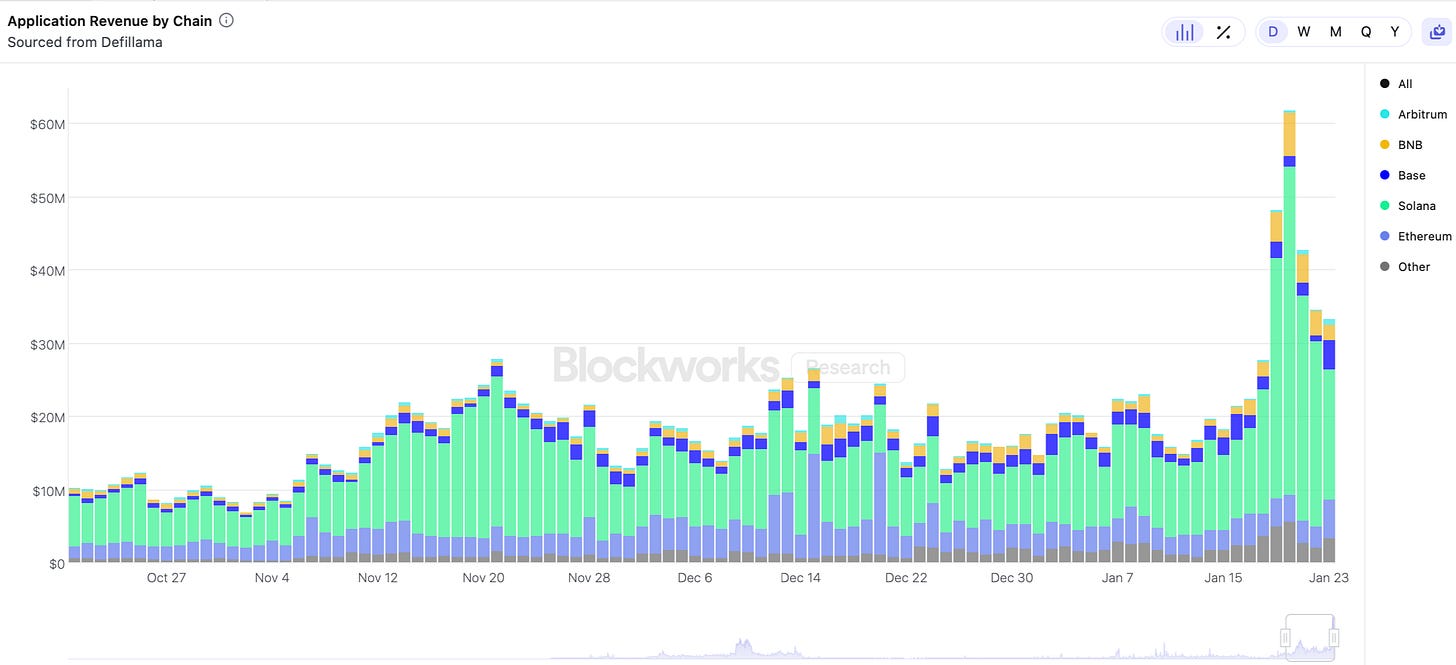

If you want to see how well Solana’s doing, the data speaks for itself.

Amazing. Dominant. Apps too? Wow.

Now that’s a great narrative.

But just for the sake of argument, before we declare victory for the manlets over the virgin Ethereum researchers, let’s look at where the REV is coming from.

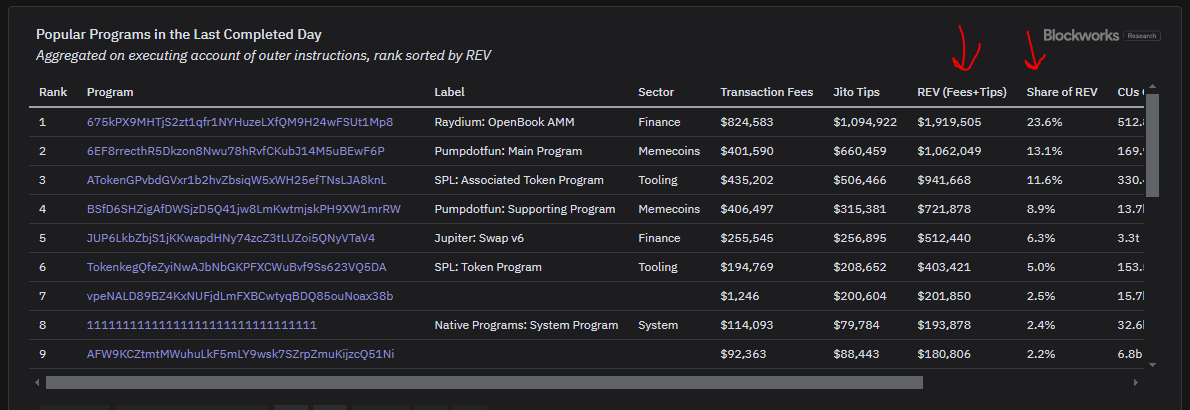

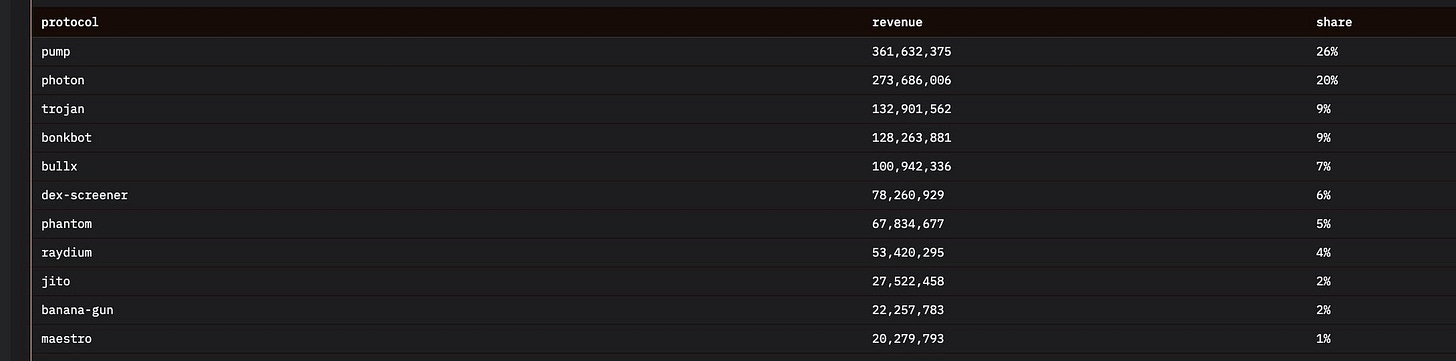

It’s probably a healthy mix of all of the best apps in crypto. Groundbreaking, innovative DePIN like Helium, a CLOB that’s building Decentralized NASDAQ, organic stablecoin payment volume, complex DeFi transactions, and sure, maybe some of it from memecoins. Right?

Let’s see.

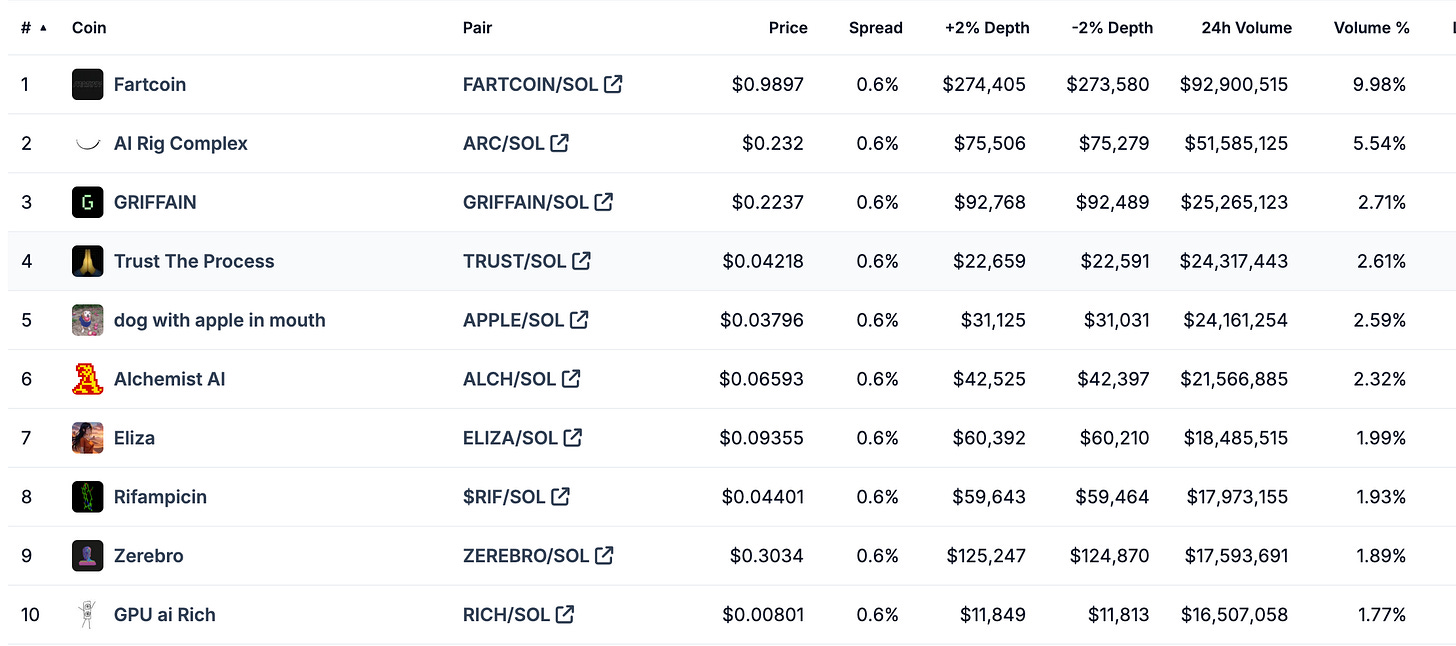

Wait - it’s all pump.fun and a bunch of telegram bots for trading memecoins?

Where are the groundbreaking apps? Where is DePIN? Where’s global price discovery for events occurring in Singapore or London? Where are the elite, IMO-medalist developers?

We’re increasing bandwidth and reducing latency for bots trading $BUTTHOLE? ANATOLY!?!

Building the Decentralized Riverboat Casino

This post is not about whether memecoins are good or bad. Memecoins may be a good way to onramp users to crypto protocols and transfer wealth from retar “uninformed market participants” to sophisticated liquidity providers.

But the fact that Solana’s REV comes entirely from memecoin trading presents a structural problem for valuing SOL based on future REV.

Let’s backfill our own narrative. After FTX blew up, SOL was oversold, but Solana could still present a compelling story to institutional capital allocators. It had a pragmatic scaling roadmap and was culturally legible to investors familiar with Silicon Valley tech startups.

As the effort to pitch SOL was successful, the price went up. This created a wealth effect, which is a beautiful thing in crypto. It’s a type of financial alchemy, where a token price increase (which has basically nothing to do with tech) is transmuted into on-chain activity (which looks like it’s driven by superior tech).

You can think of a wealth effect as a pressure cooker full of money being heated, and the only way to release the pressure is for capital to flow to stupider and riskier assets, like CryptoDickButts or this:

As activity increases, thought leaders can backfill a compelling narrative, increasing the price of SOL and creating more activity. Applications launch tokens, adding more capital to the system (an example: Jito effectively airdropped a new car to everyone in Solana DeFi). Call that a flywheel.

According to our narrative, the primary reason that memecoin activity took off on Solana (and not a similarly scalable alt-L1 or L2) is the SOL wealth effect. Solana’s cheap transactions were a necessary precondition, but a wealth effect was required for memecoin mania to grow to its current size.

Time is a flat circle

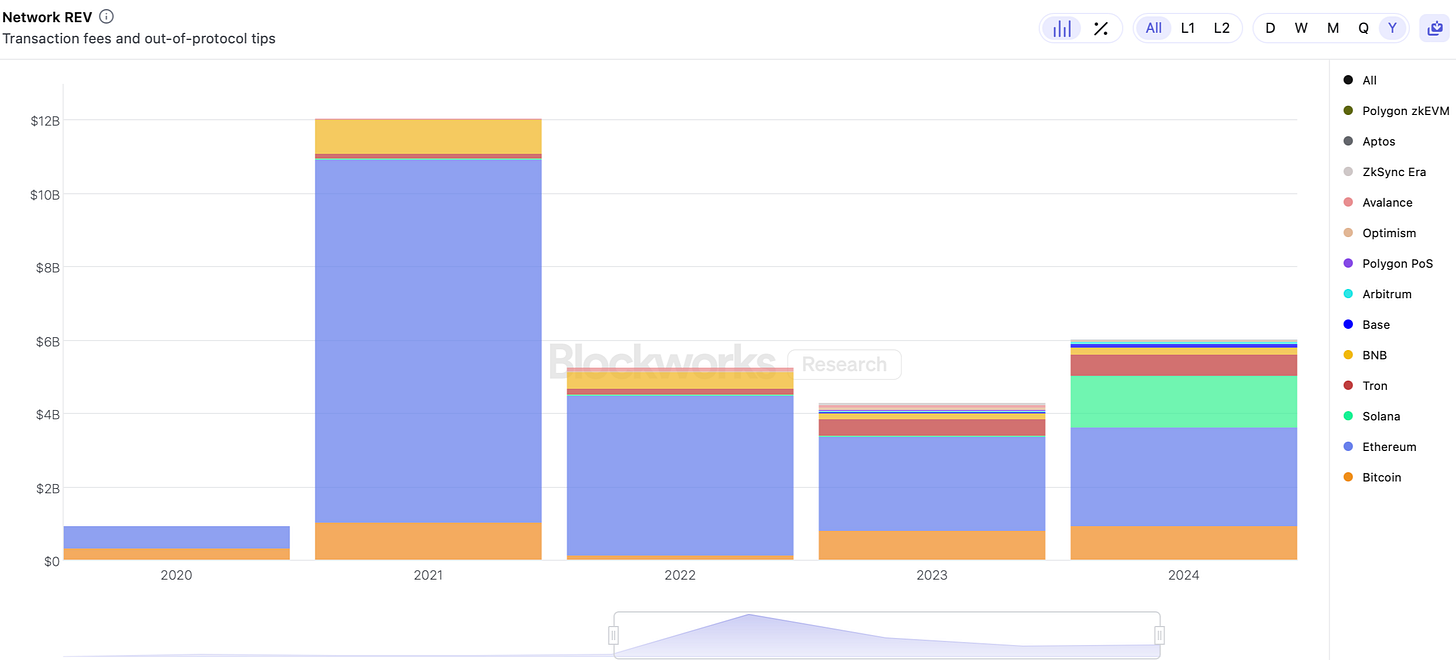

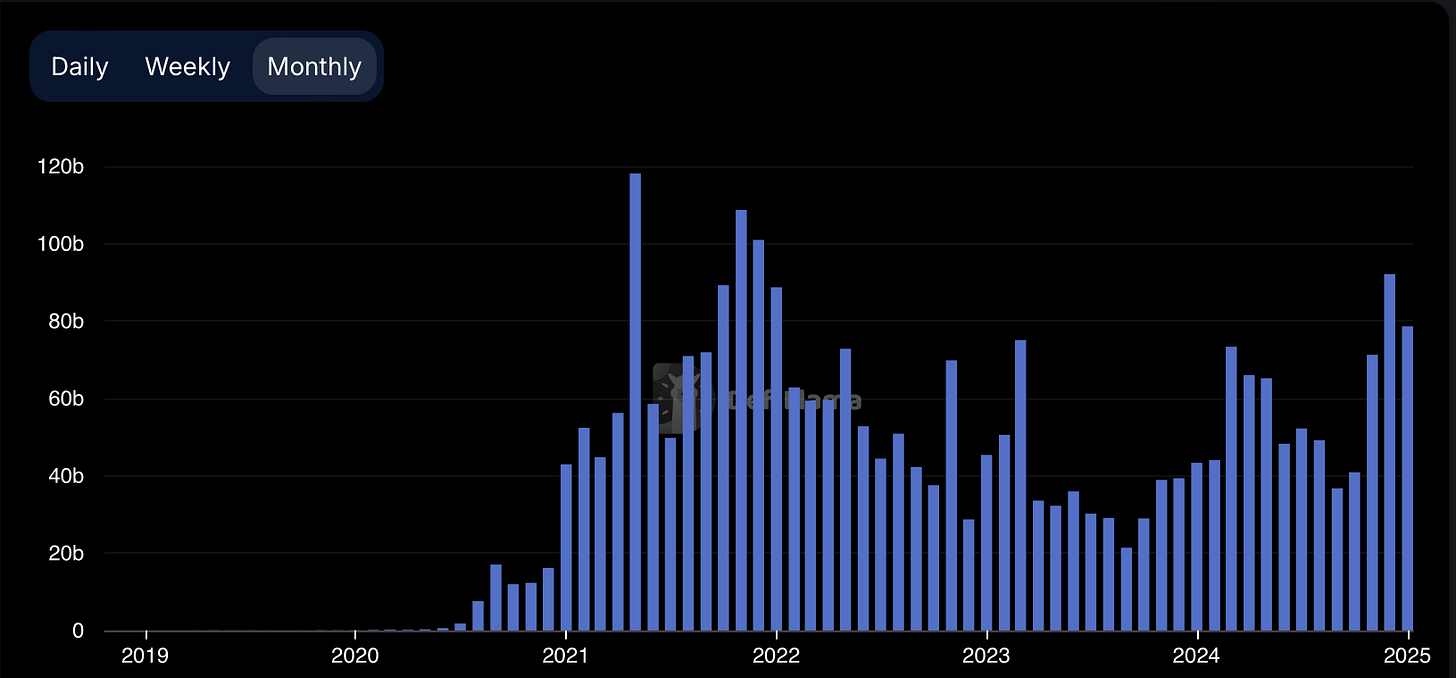

This has all happened before. If we look at 2020-2021, we see incredible growth in REV on Ethereum. In the last bull market, ETH holders’ new wealth flowed into increasingly volatile on-chain assets, like NFTs and memecoins.

Speculation on highly volatile assets disproportionately generates REV because users are willing to pay higher priority fees and MEV rates to gain exposure to volatility. The value of a memecoin trade is heavily dependent on the trade’s position in a block, so block proposers, who control ordering, can capture more value. This yields a much higher take rate for the protocol than other forms of on-chain activity.

However, we can see that as the market cycle changed, the highly speculative activity (in NFTs and memecoins) on Ethereum evaporated. Using Ethereum REV in 2021 as a basis for estimating future REV was fundamentally flawed.

Memecoin REV won’t last (and won’t save you)

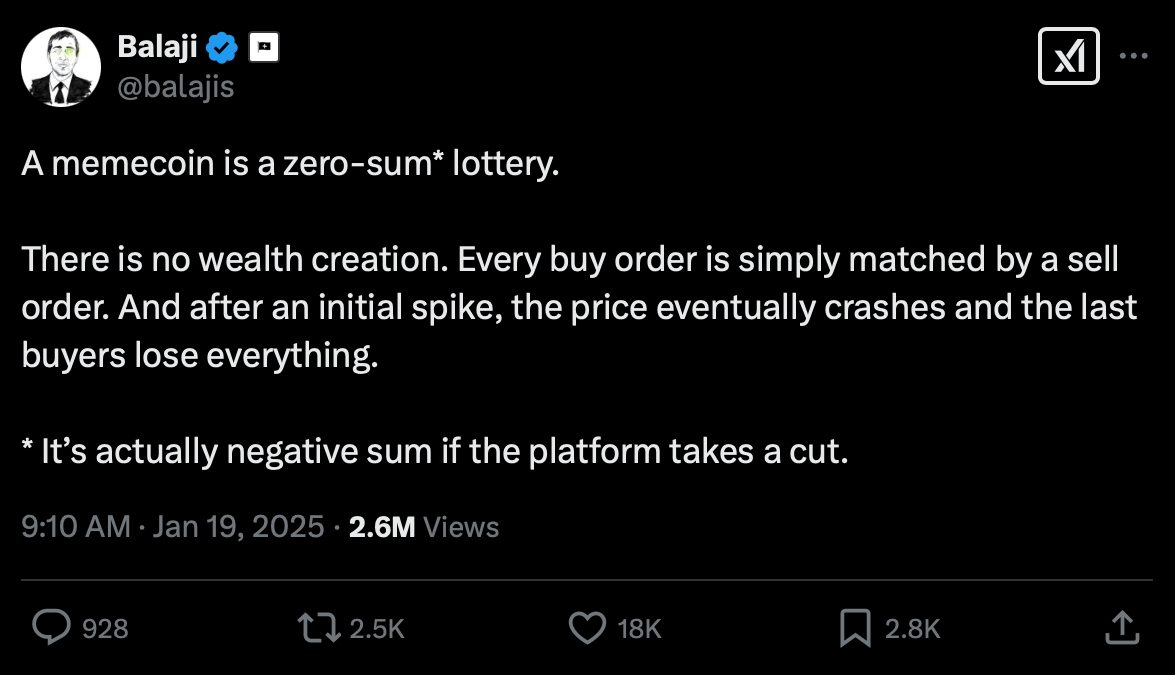

Just as REV generated by memecoins wasn’t sustainable on Ethereum, it will not be sustainable on Solana. While memecoins might be fun, memecoin speculation is zero-sum.

The rake taken from memecoin gamblers is extremely high relative to other forms of gambling, and eventually the gamblers run out of money. High fees and MEV might be great for boosting REV, but in a zero-sum game that isn’t generating any economic value, the consequence is that they pull liquidity out of the ecosystem. Every dollar paid in REV means less money for future memecoin trading and less future REV.

For this reason, it’s difficult to argue that REV growth will continue and eventually justify SOL’s market cap.

The current ratio of SOL’s FDV (~$150b) to 2024 REV ($1.4b) is about 100:1 (source). If we’re generous and annualize based on Q4 REV ($825m), we’re left with a ratio of 45:1. Better, but this still assumes that memecoin volumes will grow over time. Given that this is unlikely (see ETH’s annual REV decreasing from $10 billion to $2.6 billion in the last market cycle), it’s difficult to justify SOL’s valuation via expected future REV.

The popular counter is that Solana will simply scale its blockspace 10x or 100x, and REV will scale proportionally.

The problem is that even if Solana can scale throughput by 100x, where is it going to find 100x more sweet, innocent order flow willing to be exploited (excuse me, “extracted”) via sandwich attacks and snipers to buy memecoins, except in Ken Griffin’s most perverse fantasies?

In order for memecoin volumes to continue growing and to compress SOL’s P/E ratio, we need an increase in the price of SOL to boost the wealth effect. But this defeats the purpose; we’re trying to compress the P/E ratio, not expand or maintain it.

Other applications, like DeFi, DePIN, and payment applications won’t produce the same amount of REV per unit of blockspace. A sophisticated trader loaning blue-chip assets to earn 10%, or someone playing a game, might consume the same amount of blockspace but yield far less REV.

Mercenary Memecoins

Memecoin volumes will also tend to follow new token wealth effects to new chains.

You might argue that the reason that memecoin issuance migrated from Ethereum to Solana is that Solana is more scalable and a better venue for trading, and that Solana’s technical advantages mean that it will continue to be the home for degenerate gambling. Not exactly Decentralized NASDAQ, but being the hub for unhinged speculation must be worth something.

This ignores that the proximate cause of memecoin mania was the SOL wealth effect. For instance, BONK price and trading volume followed behind SOL in late 2023. We can see that the same is true for DEX volumes, especially memecoin volumes, which only started to take off in March, 2024, after SOL had 10x-ed from its post-FTX lows.

As new chains launch, especially high-performance L2s (like MegaETH and Rise), it’s likely that these chains can provide an even better venue for memecoin traders. These chains will launch with new tokens and fresh wealth.

They won’t be decentralized or synchronizing the world’s information at the speed of light, but no one trading $FARTCOIN cares - the risk they’re taking gambling on memecoins dwarfs any risk introduced by centralization. L2s can offer lower latency, better performance, and a higher transaction success rate, a better tradeoff.

What about Ethereum?

The narrative about REV growth on Solana is also used to advocate for changes to Ethereum. The implicit argument is that Ethereum must scale to regain the activity (and REV) that it lost to Solana. This doesn’t make sense when you consider that Solana’s activity is entirely driven by memecoins. Scaling L1 execution by 5x or 10x won’t bring memecoins back to Ethereum L1; Solana will still have lower fees and a stronger short-term wealth effect.

If DeFi as a whole were migrating to Solana, we’d expect to see a meaningful drop in volumes on Ethereum. But DEX volume in December on Ethereum was within 10-20% of all-time high monthly volume, even including the 2021/22 bull market when ETH price action was much wilder and NFT and memecoin volumes were far higher.

This lends some support to the idea that there are different categories of DeFi users. While memecoin traders are increasingly on Solana, there’s a massive amount of capital remaining on Ethereum. Citing REV or DEX volumes as evidence that Solana is dominant in DeFi in general is misleading.

If we use DeFi TVL as an indicator of the type of activity that’s occurring on each network, we can see that Ethereum has 6x Solana’s TVL (despite depressed ETH prices), implying that the activity occurring on Ethereum is qualitatively different from on Solana. From a DeFi perspective, you can’t really do much with memecoins; asking for a friend, what are the collateral requirements for a loan on $BUTTHOLE?

A counter is that nearly all on-chain activity is pure speculation, so characterizing Solana’s activity as just memecoin trading when Ethereum activity isn’t tied to real-world economic activity is hypocritical. My first response would be: recommend no more statements like this for the sake of our industry.

More seriously, there’s a clear argument that Ethereum has a more developed and vibrant DeFi ecosystem, even if it trails in REV, because it still shows strong TVL and activity even without significant memecoin issuance.

Revenge of the Rollup-Centric Roadmap

We’ve argued that SOL’s value cannot be justified by projected future REV. It turns out that SOL is still jockeying with BTC and ETH to be the first link in the human centipede of cryptoasset capital flows.

But memecoins present another structural challenge for Solana’s longterm viability because memecoin traders are better served by L2s.

L2s can operate with extremely low-latency at higher throughput. They can respond more quickly to issues and downtime without the coordination overhead of decentralization. They can more easily filter spam transactions.

You might argue that Solana’s high-performance client is a durable advantage, but open-source technology loves to be commoditized. It’s ironic that VCs cite Solana’s technical advantage over Ethereum when teams like Eclipse and Atlas are already deploying SVM L2s on Ethereum.

Ethereum’s liquidity and TVL make it a better venue for L2s. Moreover, Ethereum explicitly trades performance for liveness and availability, which is a better tradeoff for L2s, which do not need high throughput on L1. The nightmare scenario for an L2 is being unable to finalize or bridge for hours because the L1 is offline.

This presents a real risk for Solana, as its REV growth is entirely generated by activity that is highly procyclical and can be better served by other chains.

Conclusion

The optimistic case for Solana is that it is at the same point as Ethereum in 2021, where activity eventually yields a more mature DeFi ecosystem. But this isn’t guaranteed.

DeFi activity on Ethereum is dominated by fee-insensitive whales who care about decentralization, availability, and security. There is a world in which retail users trade memecoins on Unichain, while whales trade UNI on Ethereum. L2s can offer a better environment for memecoins and long-tail cryptoassets, and Ethereum offers a better environment for whales, as it prioritizes liveness over performance.

The more pessimistic case for Solana is that it isn’t really succeeding in following its North Star and building Decentralized NASDAQ. Traders care about latency and a guarantee that their transactions will executed. It’s hard to get transactions included on Solana during volatile periods and latency isn’t competitive with (more centralized) L2s.

It’s more accurate to say that Solana is succeeding in building the Decentralized Riverboat Casino, a venue that’s designed to provide traders, who are flush with cash from a short-term wealth effect, maximum exposure to volatility and risk.

This might morph into new forms of gambling when memecoin mania dries up, but this is maybe unlikely, given that gamblers don’t care about Solana’s advantages over L2s, but care a lot about the advantages of (centralized) L2s over Solana.

But back to the point. It’s easy in crypto to backfill narratives that support a particular view (and heavy bags). It’s especially easy when your story includes compelling tech and activity generated by a speculative frenzy. But this is exactly why we should be skeptical of stories that clearly favor the people telling them.

I think that Ethereum has done itself a disservice by taking arguments made by its critics at face value. This includes stories about REV and comparisons to Solana’s economic metrics, but more importantly, arguments about value accrual and L2s being parasitic to Ethereum L1. I’ll (hopefully) write about this in a future post.

Thanks to the many people who reviewed this post. Dan Smith, king of REV, master of data, who probably disagrees with my SOL bearishness but left thoughtful comments, including that the JTO airdrop was like giving a new car to everyone in Solana DeFi; Josh Rudolf; and especially Shelby Kinney-Lang, Jaime Lalinde, and Connor Southard, three of the best writers and narrative-men in crypto. Reach out to them if your project needs to tell a story (it does).

This post has been hanging out in my drafts for a few months, so it doesn’t include $TRUMP, $MELANIA, Solana downtime, or the recent market sell-off. Those things don’t meaningfully affect the argument, but that’s why they aren’t mentioned.

great insights